#News #Latest #trending #india

According to industry experts, India’s telecom operators are planning to invest more than Rs 1 lakh crore in artificial intelligence (AI)-enabled data centres, edge infrastructure and cloud functions in the next two-three years to shift from network expansion to compute-intensive digital infrastructure. Their target is to increase venture revenue growth to 40 percent of total revenue.

Deloitte India partner Aditya Khaitan said in an ET report that 20-30 per cent of the FY2027 investment budget is expected to be transferred towards building AI data centres, edge infrastructure and cloud functions. He further said that this change will vary between telecom service providers. More will be seen from the top two telecom companies which have crossed the peak capex cycle on their 5G investments.

investment of one lakh crore rupees

This change can change the direction of revenue of Indian telecom companies. Currently, 15-30 percent of the total revenue of these companies comes from venture revenue. Khaitan said that driven by services beyond traditional connectivity, including cyber security, cloud computing, Internet of Things (IoT) platforms and AI-based solutions, the contribution of B2B (business-to-business) services to total revenues could increase by 30-40 per cent. Shilpa Malaiya Singhai, MD, Alvarez & Marsal India, quoted an ET report as saying that Indian telecom companies have committed to invest more than Rs 1 lakh crore for AI-centric data centers in the next two-three years.

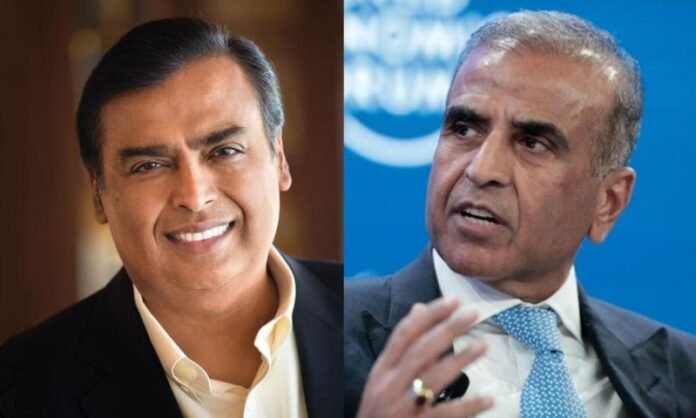

Focus of Airtel and Jio

In late 2024, Bharti Airtel announced plans to invest about Rs 5,000 crore to expand its Nxtra capacity from 240 MW to 400 MW. Singhai said India’s two leading telecom operators have made strategic investments in gigawatt capacity AI-centric data centres, which will potentially add a massive 4-5 gigawatt to the country’s existing digital infra. These investments include the Bharti Airtel-Google partnership for an AI hub of about 1 GW in Visakhapatnam, while Jio plans to set up an AI hub of about 3 GW in Jamnagar.

Singhai said Jio is leveraging this opportunity from a full-stack AI factory and platform monetization approach by integrating data centers with its broader AI ecosystem, while Airtel is continuing its Nxtra data center expansion to expand its enterprise portfolio with deeper sovereign cloud and enterprise AI services.

focus shifted

Amardeep Sharma, CTO of Praruh Technologies, said in a media report that the move was a shift from “connectivity-centric” infra to “compute and data-centric” infra. He said the main phase of 5G rollout in India has already been completed, and telecom capex is clearly moving away from just connectivity investments towards AI, cloud and data center infra. On cost savings, Singhai said AI deployments focused on reducing operational expenses will start yielding benefits in the next 18-24 months.